Digital transformation is a significant issue for companies today. However, many shy away from this innovation or have problems implementing it. However, with a view to the future, it will only become more complicated instead of easier if one continues to close oneself off to digital transformation. There are indeed some companies that are proactively tackling this undertaking and have already achieved satisfactory results with the help of digital transformation.

Sanitas builds an impressive customer portal

The health insurance company Sanitas www.sanitas.com convinces with its new online platform. A holistic approach was chosen, which is reflected in the final product. For example, this platform has a user-friendly UI (user interface) and can also be easily operated from a smartphone. And this is just the beginning.

In addition to a customer portal, the platform also has a partner portal. It also offers a very clear homepage and refers to various useful links such as health programs, supplementary insurances and the in-house app. Also available and easy to find are a premium calculator and the contact form. At this point it becomes clear that the topic of "customer service" has been professionally addressed and implemented, because here it is made as easy as possible for the customer to get in touch with Sanitas. This aspect is exceedingly important, as even the nicest platform is of no use if the customer cannot operate it or determine any benefit.

This has been digitized: Users of the Sanitas customer portal app benefit from:

- No more searching for the vaccination card. The digital vaccination card is always at hand on the cell phone in case of emergency.

- Scan medical bills securely and quickly online

- Search help for doctors, hospitals, pharmacies and generics in an emergency

- Digital insurance card on your cell phone

- Franchise and deductible always at a glance

Zürcher Kantonalbank launches the first payment app

ZKB has also recognized the benefits of digital transformation and acted accordingly. After all, bank customers also want to be able to access their money at any time and find out about the performance of their securities.

Here, a multichannel approach is pursued to pick up customers at the point where they try to get in touch with their bank. ZKB already built the first online bank 20 years ago and thus proved its sense for trends and relevant innovations back then. In addition, nowadays 5 times more transactions are made than in the past, yet only 25% more employees are available.

Zürcher Kantonalbank (ZKB) was the first bank to go online with its Twint app. ZKB Twint introduced a payment solution that already makes cash obsolete today. The app combines Paymit's P2P payment solution with the Twint payment app.

And that's far from all. ZKB is working on additional services that offer customers more security and simplify their lives. These include both a cash delivery service that brings cash directly to the customer's home and a login for eBanking using fingerprints.

ZKB also invests in startups and is constantly on the lookout for interesting fintech companies.

What has been digitized?

ZKB customers benefit, for example, from:

- direct connection to the account without credit card

- fast payment without cash card

- money transfer to other users

- outsourcing of payment transactions to Swisscom

- login for eBanking using fingerprint (currently being developed and revised)

Swiss Life: Modern online pension provision

Swiss Life is pursuing an omni-channel strategy that provides customers with a uniform level of expertise across all channels. A prime example of this is Swiss Life MyWorld, a portal that simplifies communication for customers and also provides them with comprehensive information by allowing them to access pension data online at any time. Swiss Life has also set up its own lab under the name "Swiss Life Lab". Here, potential trends are monitored and opportunities analyzed and evaluated to offer policyholders further benefits or simplifications.

Digitization on multiple fronts. Swiss Life's strategy for digital transformation.

- Transparency through the customer portal Swiss Life myWorld: Plan private and occupational benefits online

- MyWorld Community: Empower employees and strengthen customer orientation. Employees and customers can actively contribute ideas here

- Establishment of a new platform called Swiss Compare, which significantly simplifies the work of brokers

Medela establishes cross-channel digital concept

Medela AG, the world market leader for breast pumps, made digital transformation a priority several years ago; it is not without reason that the Swiss brand is known worldwide for its high quality. For example, the company was already working on its first platform in 2009. At that time, however, this was initially oriented towards pharmacies and specialist retailers in general.

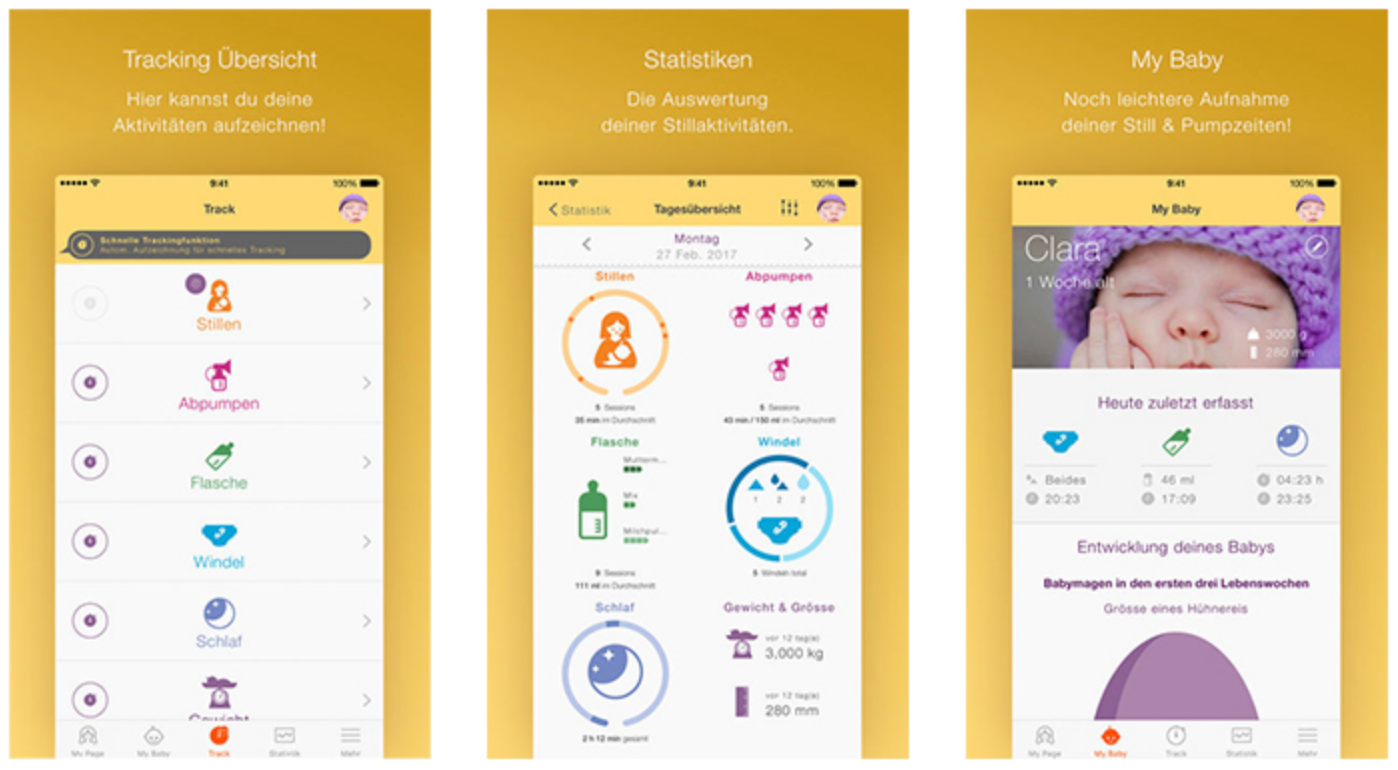

But the end customer should not be disregarded either The MyMedela app is a good example of how this challenge was successfully mastered. The company also offers the web-based Medela Rental Tool application, which can be used to digitize processes and handle the distribution of breast pumps more efficiently. In addition, the website offers a search function that displays the nearest pharmacy offering Medela breast pumps.

In the meantime, both B2B and B2C sales have been digitized and new markets can be added very quickly, at least from the technical side. Thanks to its proactive approach, Medela AG already won the Swiss Digital Transformation Award in 2016.

What has been digitized:

- Own app called MyMedela becomes helper for breastfeeding mothers. For example, breastfeeding and pumping times can be recorded and evaluated.

- A B2B online store for pharmacies, hospitals

- A Location Finder, which makes it easy to find pharmacies with Medela products in their range

Axa Winterthur succeeds in digital transformation

Axa Winterthur has also been attaching great importance to digital transformation for several years now. For example, all channels are mobile-optimized so that visitors can easily browse the insurer's product range via smartphone. This option is particularly recommended in view of the high number of smartphone owners - and their trend is still rising.

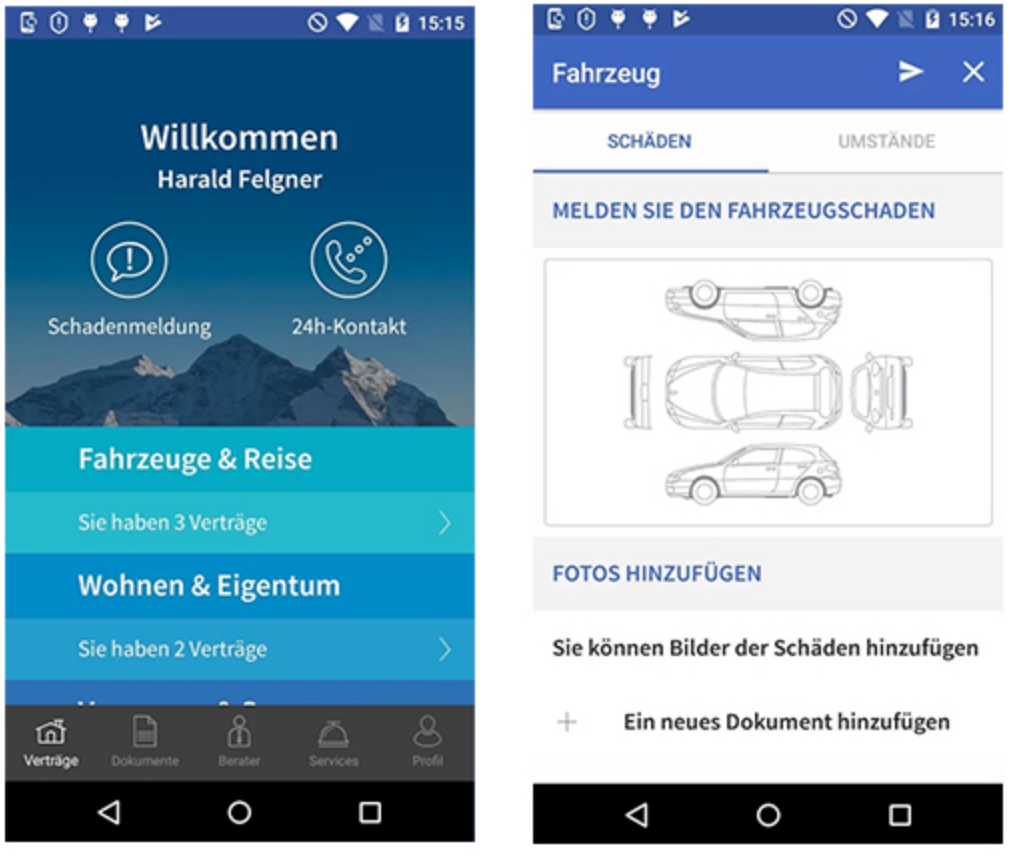

UX is an aspect that was also taken into account during development. The first step was to work with a beta live version. AXA used this to gather feedback from users and incorporated this into the design of the new platform. The myAXA customer portal was also revised and a myAXA app was designed. This allows customers to access and digitally manage their data at any time. In addition, damage can be reported immediately via the app or bank details can be changed. Another example of how an effective digital strategy should be applied to all existing channels.

This was digitized:

- The new customer portal myAXA offers users fast and uncomplicated access to their data.

- The myAXA app also provides a round-the-clock digital point of contact for the insurer's customers on their smartphones.

- Users have a constant overview of the coverage of their insured items.

- Simple and fast claims reporting via the app - even on the go

AXA Winterthur is launching AXA Sure, the first insurance app that shows customers simply and clearly whether the items they hold most dear are really insured against any claim.